Send Money to Europe | Fast EUR Transfers at the Best Rates

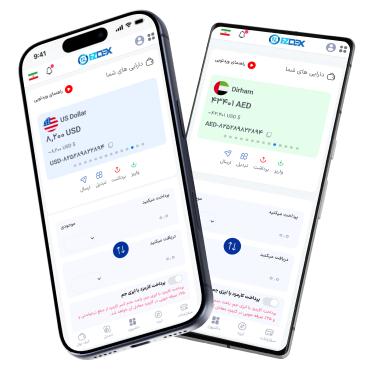

EZDEX finds the most competitive Euro transfer rate in seconds! In this platform, EUR transfer rates are compared across hundreds of trusted exchange offices, ensuring you always get the best available price. This allows you to send money to Europe quickly, securely, and fully online.

You can transfer funds to Germany, the Netherlands, France, Turkey, and other EU countries in the shortest time and with the lowest fees, using various currencies such as Tether, USD, and more, either in cash or via bank transfer.

How to Transfer Money to Europe

Create an Account on EZDEX

Simply register on EZDEX and verify your account to access all the platform’s features and services.

Fund Your Account & Convert to EUR

Top up your EZDEX account with any currency you like, such as AED, TRY, USD, cryptocurrency, etc., and instantly convert your balance to EUR.

Withdraw EUR to a Bank Account

By selecting the "Send" option and entering the destination account details and amount, you can transfer any amount of Euros to the desired bank account.

Money Transfer to European Countries

Sending money to European countries is one of the most common financial needs in business, migration, education, and even online shopping. With the increase in migration and studying in Europe, people often need to send money for university fees, rent, medical services, business transactions, or financial support for family members.

Using EZDEX, you can send your funds to all European countries in the shortest possible time. Money transfers to Germany, France, Italy, the Netherlands, Spain, and other EU countries are carried out with competitive rates, transparent fees, and complete security. EZDEX, with connections to reputable exchanges, provides the fastest, safest, and cheapest way to send funds to Europe. It is the smarter alternative to SEPA transfers, faster, lower-cost, and without the usual limitations.

EUR Transfers to Turkey

The high volume of economic, tourism, and student transactions has made sending Euros to Turkey highly important. Many Turkish universities accept tuition fees in Euros, and a significant portion of business transactions is conducted in this currency.

For sending money or making business and educational payments to Turkey, the decentralized and smart platform EZDEX is the best choice. EUR transfers to Istanbul and other Turkish cities are fast, use precise real-time rates, and have minimal fees. After the transfer, you can either deposit Euros into Turkish banks accounts or request cash pickup from exchange offices in Istanbul and major cities.

Why Use EZDEX

When transferring money to Europe, users often face challenges such as differences in exchange rates, lack of transparency, needing to check customer reviews, or finding a reliable exchange.

EZDEX addresses this by providing real-time exchange rates, performance comparisons, user reviews, transaction history, and faster transfer route selection. Users can access all the information in a transparent and user-friendly environment without multiple searches or phone calls.

The best part is the variety of payment methods. You can top up your balance using crypto like USDT or BTC, or with fiat currencies such as USD, AED, TRY, or almost any currency you prefer. Once topped up, simply convert your funds to EUR and send them directly to bank accounts across Europe. You can even choose cash delivery in European countries if your recipient prefers receiving money in cash.

Best Price Guarantee for Sending Funds to Europe

One of the main concerns when sending money to European countries is finding the best price and lowest fees. Even a 1-2% rate difference can become significant for medium or large amounts. In addition to the Euro exchange rates, transfer network costs, bank fees, and transaction time are important factors in choosing the right method.

Therefore, checking multiple exchange rates and comparing fees before placing an order is essential. Price transparency allows users to send money more confidently and avoid hidden costs. Ultimately, EZDEX allows you to automatically compare multiple exchange rates side by side and choose the best option for EUR transfers at the lowest cost.

Different Methods to Transfer Funds to Europe

There are various ways to transfer Euros in Europe, and each method can be chosen depending on speed, cost, destination, and required features.

SEPA Bank Transfers

The most common and low-cost method for money transfers within Europe. Using IBAN numbers and the unified banking system, transfers usually take 1 business day. For transfers within the EU, SEPA is one of the best options in terms of cost and security.

SWIFT International Network

Used when the destination is outside SEPA or the transfer requires intermediary banks. SWIFT sends money to almost all countries worldwide but is slower and more expensive than SEPA. It is a standard, reliable option for high-value international transfers.

Online Exchanges

Online exchanges allow sending Euros to bank accounts, cards, or even cash pickup. This method usually offers faster speed, better conversion rates, and a simpler process than banks. Users can send transfers online without visiting in person, though finding a reliable online exchange with good rates can be challenging.

Digital Services like PayPal

Platforms like Wise, PayPal, Revolut, or N26 provide Euro transfers with high speed, transparent fees, and competitive conversion rates. Wise, in particular, is known for low-cost international transfers. These services are ideal for users with digital accounts or frequent transactions, but both sender and recipient need accounts on the platforms.

Traditional Exchange Offices

Traditional or in-person exchange offices remain a trusted method for many. They allow sending funds and exchanging cash currency. The drawbacks are limited rate transparency and the need to visit in person, sometimes requiring visits to multiple offices to compare rates.

EZDEX

EZDEX is a smart, modern solution that simplifies and speeds up the process of choosing an exchange. The platform compares exchange rates in real-time and directs your order to the best exchange with the most suitable Euro transfer rate. Users can also view reviews, ratings, and historical performance of exchanges. This transparency allows users to confidently choose the best transfer method.

You can pay for EUR transfers either as cash or via bank deposit. This means you can fund your EZDEX account via bank transfer, cryptocurrency, or in person with cash, and then transfer your balance to European banks.

Comparison Table

The table below summarizes the above methods, providing an overview to help you choose the method that suits you best.

| Transfer Method | Speed | Fee | Best For | Advantages | Limitations |

| SEPA Bank Transfer | 1 business day | Low | Transfers within Europe | Standard, secure, low fees | Only available for SEPA member countries |

| SWIFT | 2–5 business days | Medium to high | International transfers | Can be used worldwide | Longer processing time, intermediary bank fees |

| Online Exchanges | A few hours to 1 day | Low to medium | Fast transfers with competitive rates | High speed, order without visiting in person | Requires exchange verification |

| Digital Services (Wise, PayPal, etc.) | Instant to a few hours | Low to medium | Quick and frequent transfers | Transparent rates, easy-to-use interface | Restrictions in some countries/accounts, both parties must be registered |

| Traditional Exchanges | 1–2 days | Variable | Users who prefer in-person transactions | Trusted, offers in-person consultation | No real-time rate transparency, requires visiting physically |

| EZDEX | A few hours to 1 day | Low | Families, students, businesses, travelers, and frequent currency converters |

Real-time rate comparison, user reviews, cash and bank transfers, smart routing |

Requires placing orders online |

On EZDEX, international transfers are simpler and smarter. The system automatically compares exchange rates in real-time and directs your order to the best exchange with the most favorable rate. This eliminates the need to search multiple exchanges or worry about rapid rate changes.

Additionally, EZDEX allows viewing user reviews, exchange ratings, and historical performance. Partner exchanges are reputable and hold guarantee deposits on the platform. This transparency provides a more informed, secure, fast, and reliable Euro transfer experience for users.