What is IBAN? A Guide to Understanding & Using IBANs for International Transactions

Today making international bank transfers is easier than ever. If you've ever transferred money abroad, you’ve likely encountered a code called the IBAN. Understanding what an IBAN is, why it’s important, and how to use it, is essential for anyone looking to send or receive funds across borders securely and efficiently. In this guide, we’ll explain everything you need to know about IBANs to make transactions worldwide.

Content Overview

What is an IBAN?

IBAN is an abbreviation for International Bank Account Number. It’s a unique, standardized format which is used internationally to identify bank accounts across borders.

The IBAN system was developed to simplify the process of sending international payments, minimizing errors, and ensuring the accuracy of financial transactions.

An IBAN is made up of a combination of letters and numbers that identify not only a specific bank account but also the country, bank, and branch associated with that account.

This standardization makes it easy for banks to confirm that the account details are correct, significantly reducing issues that can arise from incorrect or incomplete information.

Why Was the IBAN Created?

Before IBANs, international transactions were often delayed or went to the wrong accounts due to differences in how banks in various countries structured their account numbers.

The IBAN was introduced in Europe in 1997 by the International Organization for Standardization (ISO), specifically under ISO 13616. Over time, it became widely adopted, and today, more than 70 countries use IBANs to streamline cross-border banking.

The main reasons for implementing IBANs were to:

- Reduce Errors: By having a standardized account number format, IBANs help ensure that payments are directed accurately.

- Enhance Efficiency: With IBANs, banks can automatically verify account details, making international transactions faster.

- Improve Security: A unique, standard code adds a layer of security, protecting transactions from errors and fraud.

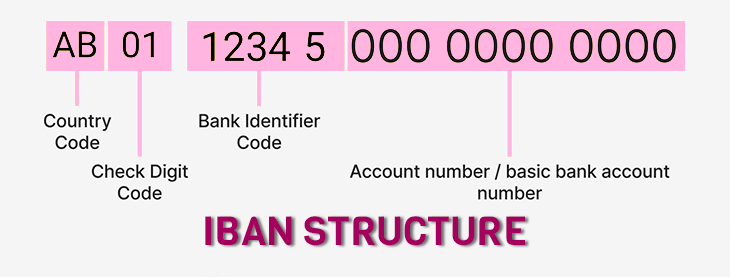

How is an IBAN Structured?

An IBAN varies in length depending on the country, but it can be up to 34 alphanumeric characters. Here's how it’s typically structured:

- Country Code: The first two letters represent the country. For example, DE for Germany, FR for France, and GB for the United Kingdom.

- Check Digits: The next two numbers are check digits. These numbers help banks verify the accuracy of the IBAN before processing the transaction.

- Bank Code: Following the check digits is a bank identifier, usually a few letters or numbers, that identifies the specific bank.

- Branch Code (optional): In some countries, a branch identifier may also be included to specify the bank branch.

- Account Number: The final portion of the IBAN is the actual bank account number, which varies in length by country.

Each part of this IBAN code is important to ensure that the money reaches the correct destination without delays.

🔗Also Read: Top banks of UAE and Dubai

How to Find Your IBAN

Finding your IBAN is easy and can typically be done through your bank’s website, mobile app, or by checking your bank statements. Here are a few simple ways to locate it:

- Bank Statement: Many banks include the IBAN on printed and electronic statements.

- Bank’s Website or App: Log into your online banking account, and you’ll likely find your IBAN listed along with other account details.

- Contact Your Bank: If you're unable to find your IBAN, reach out to your bank’s customer service for assistance.

⛔️ Avoid guessing or creating your own IBAN, as each code is unique and generated by the bank specifically for your account.

Why is an IBAN Important?

An IBAN is essential when making international bank transfers, particularly within Europe and other countries that have adopted the IBAN standard.

With a standardized IBAN, banks can easily confirm the correct destination account, reducing the risk of errors. Because IBANs are recognized internationally, banks can process cross-border transfers faster and more efficiently. An IBAN acts as a secure identifier that prevents funds from being misdirected to the wrong account.

In many countries, providing the correct IBAN is mandatory for international transfers, and failure to use it correctly can lead to delays or even rejected transactions.

For example if you want to buy USDT in Dubai with bank transfer you will need the exchange's iban number to transfer fiat.

Countries That Use IBAN

The IBAN system is widely used across Europe, and many other countries worldwide have adopted it to streamline international transactions. Here are some regions and countries where IBANs are essential:

📍Europe: The majority of European countries, including all members of the European Union (EU), use IBANs.

📍Middle East: Countries like Saudi Arabia, UAE, and Qatar have also implemented IBANs.

📍Other Regions: Certain countries in Africa, the Caribbean, and even parts of Asia now use the IBAN system.

⚠️ The United States and Canada do not use IBANs. Instead, these countries rely on SWIFT codes for international transfers. However, banks in these regions can still process IBANs from other countries if necessary.

IBAN vs. SWIFT/BIC: What’s the Difference?

While IBAN is the standardized format for identifying specific accounts, SWIFT (or BIC) codes are used to identify the bank involved in the transaction. SWIFT codes are unique to each bank and are typically 8-11 characters long.

In most cases, for international transfers, you’ll need both the IBAN (to identify the account) and the SWIFT/BIC code (to identify the bank) to complete a transaction.

What is an IBAN Calculator?

If you want to generate or validate an International Bank Account Number (IBAN) based on specific bank and account information you can use an IBAN calculator.

The calculator provides a quick way to confirm the accuracy of IBANs, which are critical for ensuring smooth international transactions. By entering the bank code, account number, and country, users can either create an IBAN or verify an existing one.

Many banks and financial websites offer free IBAN calculators online including iban.com.

Read the latest news and announcements in this section.

Read the latest tutorials about payment service providers in this section.

You can access full guides and tutorial to use EZDEX services in this section.

Step by step tutorials and photo guides are available in this section.

Access the latest information about financial and economical matters in Turkey in this section.

Access the latest information about financial and economical matters in UAE in this section.

Explore expert guides, tips, and strategies for understanding and working with gold. Learn everything from basics to advanced knowledge.