What is SEPA? A Simple Guide to Understanding the Single Euro Payments Area

Introduction to SEPA Transfers & Payments

Watch the video to learn more about SEPA and how it works.

Making cross-border transactions is essential in today’s economy, especially in Europe. However, the process of transferring money across countries used to be complex and expensive. That’s where SEPA comes in. The SEPA payment method is the simplest, quickest, and most secure option if you want to make cashless payments across the European Union. This article will explain SEPA in simple terms and highlight its benefits.

Content Overview

What is SEPA?

SEPA stands for Single Euro Payments Area. It is an initiative by the European Union to streamline and simplify euro transactions across its member states.

SEPA is a transaction and payment system to transfer money effortlessly and receive it across eurozone counties.

With SEPA, individuals and businesses can send and receive payments in euros across Europe just as easily as they would within their own country.

Before SEPA was introduced, making a cross-border payment often involved hefty fees and took a lot of time due to the variations in banking systems.

💡Also Read: What is SWIFT in banking

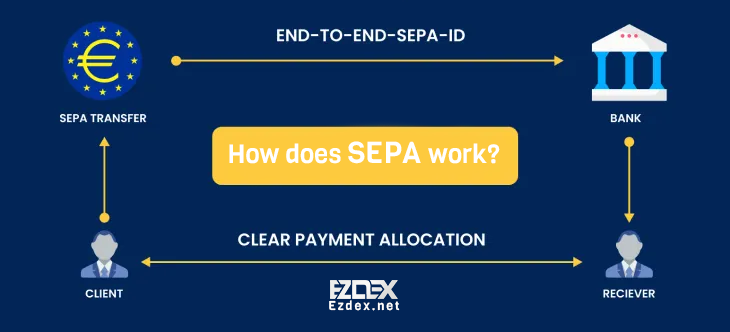

How Does SEPA Work?

SEPA makes it possible for payments to be processed under the same rules and regulations, simplifying transactions and reducing costs.

Each bank account in the SEPA has an IBAN (International Bank Account Number).

Some of the main SEPA services include:

- SEPA Credit Transfer (SCT): This service allows individuals and businesses to transfer money between bank accounts in SEPA member countries. It's a fast, reliable way to send and receive euros.

- SEPA Direct Debit (SDD): This service enables automatic euro payments, often used for recurring expenses like subscriptions or utility bills. Once set up, the payment is processed without any further action needed from the payer.

- SEPA Instant Credit Transfer: This newer service allows for real-time transactions, with the money typically reaching the recipient's account within seconds.

If you are looking for a platform to transfer money to Europe as an alternative for SEPA, you can use EZDEX services that guarantee fastest transactions and lowest fees worldwide.

How to Make a SEPA Payment

Making a SEPA payment is straightforward:

- Ensure that both the sender and the recipient have bank accounts within SEPA member countries.

- Use the International Bank Account Number (IBAN) and, if needed, the Bank Identifier Code (BIC) for the recipient’s account.

- Initiate the transfer through your bank's online portal, mobile app, or in-person at a branch.

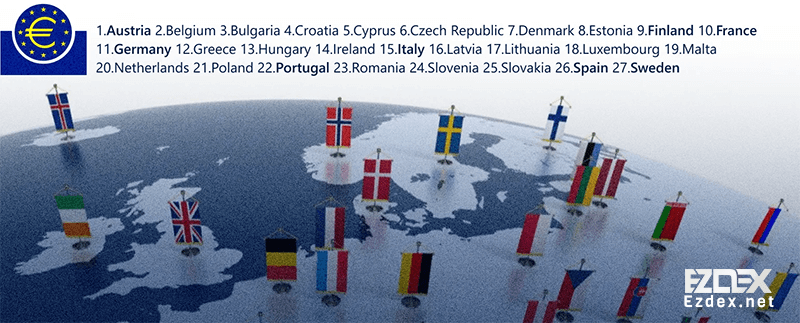

Which Countries are Part of SEPA?

SEPA includes all 27 EU member states, plus several non-EU countries and territories such as:

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovenia

- Slovakia

- Spain

- Sweden

In total, SEPA covers 36 countries. This wide reach means more people and businesses benefit from simple and seamless euro transactions.

Key Benefits of SEPA

Let us take a look at some of the most significant benefits of SEPA transfer that make it a preffered choice all around the world and over the time.

- Lower Costs: SEPA transactions typically cost the same as domestic transfers, making them more affordable for individuals and businesses alike.

- Speed: SEPA credit transfers are usually processed within one business day. SEPA instant payments make this even faster, with transfers often completed in less than 10 seconds.

- Convenience: With SEPA, managing euro payments across Europe is just as simple as handling payments within your home country.

- Security: SEPA transactions are governed by EU banking regulations, ensuring high standards of security and protection for consumers and businesses.

For businesses operating in Europe, SEPA is a game-changer. It allows them to expand their operations and reach new markets without worrying about complicated payment processes or high fees. Small businesses, in particular, benefit from SEPA’s affordability and ease of use, which supports growth and international collaboration.

Read the latest news and announcements in this section.

Read the latest tutorials about payment service providers in this section.

You can access full guides and tutorial to use EZDEX services in this section.

Step by step tutorials and photo guides are available in this section.

Access the latest information about financial and economical matters in Turkey in this section.

Access the latest information about financial and economical matters in UAE in this section.

Explore expert guides, tips, and strategies for understanding and working with gold. Learn everything from basics to advanced knowledge.

what does sepa stand for

EzDex: As mentioned in the article SEPA stands for Single Euro Payments Area.

What is the difference between SWIFT and SEPA? Please someone tell me