How Long Do SWIFT Transfers & Payments Take?

When making international payments, especially across various currencies, the SWIFT network remains one of the most common options. But as efficient as SWIFT is, the question on everyone’s mind is: How long does a SWIFT transfer take to settle? In this article, we will learn in details about the SWIFT transfer process, the factors influencing timeframes, and tips to ensure your funds arrive as quickly as possible.

Content Overview

How Long Does a Swift Transfer Take?

SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a global network that facilitates secure and standardized financial transactions between banks worldwide. SWITF doesn’t actually move money; instead, it sends payment orders between banks using a unique SWIFT code. This code identifies the specific bank and location, ensuring the funds are routed correctly.

On average, a SWIFT transfer takes 1 to 5 business days.

However, in cases in which the two banks have a pre-existing agreement, the process tends to be faster. In such instances, the recipient may receive the funds from a SWIFT transfer within one business day.

Transfers that involve an intermediary bank can still be processed relatively quickly, although this isn’t guaranteed.

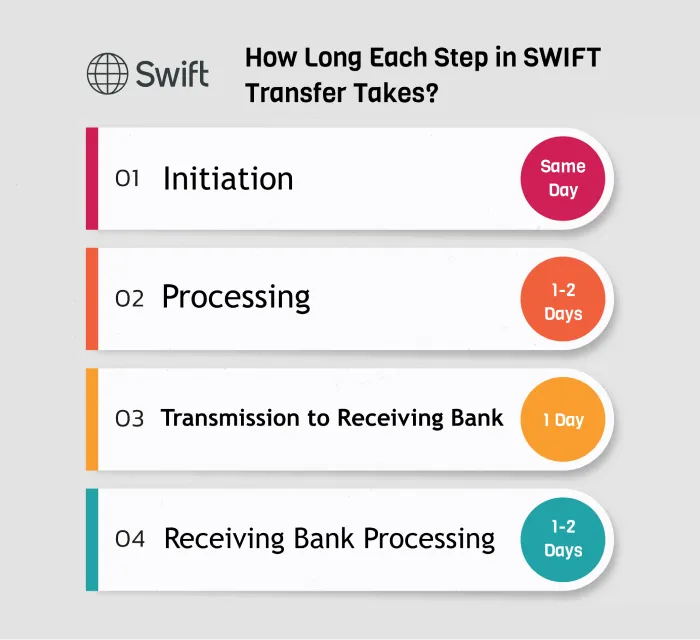

Timeline of a SWIFT Transfer Steps

Understanding the SWIFT transfer process helps clarify why it takes time. The SWIFT transfer process typically has a few key steps, each with its own approximate duration:

- Initiation (Same Day): Once you request a SWIFT transfer and fill out the necessary information, including the recipient’s bank details and SWIFT code, the bank initiates the process. This usually takes only a few hours, but it can be instant if done during business hours.

- Processing (1-2 Days): After initiation, the bank processes the transfer. This stage involves currency conversion (if needed) and compliance checks, which may take about 1 to 2 business days.

- Transmission to Receiving Bank (1 Day): The transfer message is sent through the SWIFT network, reaching the receiving bank within the same or next business day. If intermediaries are involved, each one will review and process the transfer.

- Receiving Bank Processing (1-2 Days): The receiving bank verifies the transaction, converts the currency if necessary, and credits the recipient's account. This can take an additional 1 to 2 business days.

⏰Total Time: On average, SWIFT transfers take between 1-5 business days to complete.

However, this can vary based on multiple factors. If you are planning an urgent transfer, it is essential to consider these factors and set realistic expectations.

Factors Affect Average Time for SWIFT Transfers

Here are some of the factors that may affect the average time for Swift transfers and payments.

Sending and Receiving Countries

The time taken for a SWIFT transfer can depend on the banking systems and regulations in both the sending and receiving countries.

For instance, if you’re transferring funds between countries with advanced banking systems, the process might be quicker. However, countries with complex regulations or underdeveloped infrastructure may experience longer delays.

Time Zone Differences

SWIFT transfers operate during business hours, which means time zone differences can cause slight delays.

For instance, if you initiate a transfer after the cutoff time in your time zone, it may not be processed until the next business day.

Bank Processing Times

Each bank has its own processing policies. Some banks process SWIFT transfers almost immediately, while others have scheduled times.

Additionally, if you initiate a transfer on a weekend or holiday, it will likely be delayed until the next business day.

Intermediary Banks

Sometimes, intermediary banks facilitate transfers between smaller institutions that lack a direct relationship. Each intermediary can add processing time to the overall transfer period, as each step involves verifying transaction details, fees, and regulations.

Currency Conversion

SWIFT transfers often involve currency exchange, which can also impact processing time. Some banks outsource currency conversions, which can introduce slight delays, especially if exchange rates fluctuate during the transfer.

How to Speed Up a SWIFT Transfer?

If you’re on a tight timeline, here are some tips to expedite your SWIFT transfer:

💡Initiate Transfers Early in the Day

Since many banks process transactions at specific times, starting early in the day maximizes your chances of meeting the day’s cutoff, reducing potential delays.

💡Avoid Weekends and Holidays

Transfers initiated on weekends or holidays are held until the next business day. Planning around these times can ensure quicker processing.

💡Choose Banks With Direct Relationships

Banks with established SWIFT relationships tend to process transactions faster. Choosing larger banks or ones that actively work with global partners can speed up your transfer.

💡Confirm Bank Details and SWIFT Codes

Errors in SWIFT codes or bank account information can cause delays. Double-check all details with the recipient before initiating the transfer to avoid complications.

💡Use Expedited Services if Available

Some banks offer priority processing for an additional fee, which can shorten the transfer time by a day or two.

Delays in SWIFT Transfers

A SWIFT transfer remains a trusted and secure method for sending international payments, despite occasional delays. Even with careful planning, several factors can unexpectedly delay your SWIFT transfer:

- Anti-Money Laundering (AML) Checks: Transactions involving large amounts or new international recipients may be flagged for AML reviews, extending processing times.

- Inaccurate Bank Details: Any errors in the recipient’s bank details, SWIFT codes, or IBAN can trigger reviews, resulting in delays.

- Currency Restrictions: Some countries impose limits on foreign currency transactions, which may require extra regulatory approval.

SWIFT Transfers Timing in Major US Banks

Check the below table to find out how long does a SWIFT transfer take in major banks in united state.

|

Chase |

1 to 5 business days |

|

Bank of America |

2 business days |

|

Citigroup |

2 business days |

|

WellsFargo |

1 to 5 business days |

Comparing SWIFT Processing Time with Other Transfer Methods

While SWIFT is a reliable option, it is not always the fastest. Since SWIFT isn’t always the fastest solution, other options may be more appropriate in certain cases and domestic transfers:

- The Single Euro Payments Area (SEPA)

- The Faster Payments Service (FPS) in the UK

- Electronic Funds Transfer (EFT) in Canada

- Clearing House Automated Transfer System (CHATS) in Hong Kong

Here is how it compares to other common transfer methods:

SEPA Transfers: Available within the Eurozone, SEPA transfers are typically faster than SWIFT for Euro-based transactions, often completing within one business day.

Wire Transfers: Domestic wire transfers within the same country are generally faster, often completing the same day, but international wire transfers can take as long as SWIFT transfers.

Digital Wallets (PayPal, Wise, etc.): Digital payment services can complete international transfers almost instantly, though they may come with additional fees and limitations.

Cryptocurrencies (Tether, Bitcoin, etc.): Cryptocurrencies transactions are instant with low fees, though they may come with volatility issues and limitations.

Read the latest news and announcements in this section.

Read the latest tutorials about payment service providers in this section.

You can access full guides and tutorial to use EZDEX services in this section.

Step by step tutorials and photo guides are available in this section.

Access the latest information about financial and economical matters in Turkey in this section.

Access the latest information about financial and economical matters in UAE in this section.

Explore expert guides, tips, and strategies for understanding and working with gold. Learn everything from basics to advanced knowledge.