Wire Transfer: What It Is, How It Works, Advantages, and Safety Measures

Sending money quickly and securely is important. One of the fastest ways to transfer money for helping family, doing business or paying for something, is through a wire transfer. A wire transfer allows you to send money from one bank account to another, even if the accounts are in different countries. In this guide, we will explain how wire transfers work, how to send and receive them, the costs and fees involved, and everything you need to know. This article will help you navigate the process of wire transfers with confidence.

Table of Contents

What Is a Wire Transfer?

A wire transfer is an electronic method of sending money from one person or entity to another. Sending money using this method happens typically through a bank or financial institution.

Wire transfers are widely used for domestic and international transactions due to their speed, security, and reliability.

Unlike traditional money transfers, wire transfers do not involve the physical exchange of cash. Instead, they rely on banking networks and electronic communication systems to move funds securely between accounts.

How Does a Wire Transfer Work?

Wire transfers operate through a series of secure financial networks, such as the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system for international transfers or Fedwire for domestic U.S. transfers.

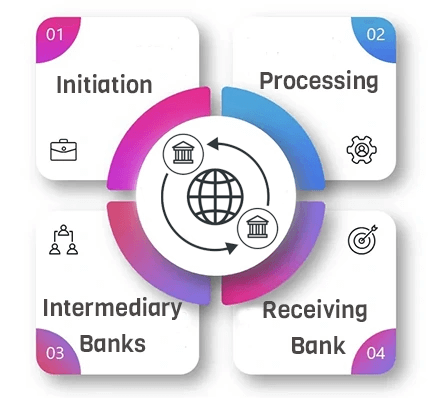

Here is how a wire transfer process:

1️⃣Initiation: The sender provides their bank with the recipient’s banking details, including:

- Recipient’s name and address

- Bank name and address

- Bank account number

- Bank routing number (for domestic transfers) or SWIFT/BIC code (for international transfers)

2️⃣Processing: The sender’s bank verifies the transaction details, ensures the funds are available, and sends the transfer request via a secure network.

3️⃣Intermediary Banks (if applicable): For international transfers, intermediary or correspondent banks may be involved to route the funds to the recipient’s bank.

4️⃣Receiving Bank: The recipient’s bank receives the funds and deposits them into the designated account. The recipient can now access and use the transferred funds.

Types of Wire Transfers

There are two main types of wire transfers:

Domestic Wire Transfers: These are transactions within the same country and usually do not take longer than a few hours to process.

International Wire Transfers: These involve cross-border transactions and may take 1-5 business days due to additional security checks and intermediary banks.

Advantages of Wire Transfers

Wire transfers offer several benefits, making them a preferred choice for businesses and individuals. Unlike some payment methods, wire transfers provide immediate access to funds and offer a high level of security. Below we are going to discuss the reasons why wire transfers remain a preferred method for transferring funds safely and conveniently.

- Speed: Transactions are processed quickly, often within the same day for domestic transfers and a few days for international ones.

- Security: Banks use encryption and authentication protocols to protect transactions from fraud.

- Convenience: Funds can be sent and received globally without physical cash handling.

- Reliability: Wire transfers are traceable, providing proof of transaction.

- Large Transactions: They allow the transfer of large amounts of money, making them ideal for real estate transactions, business deals, and emergency payments.

Also Read: best place to exchange money in dubai

Is Wire Transfer Safe?

Wire transfers are generally safe, but they can be a target for fraud if not handled properly.

There are some safety tips to ensure secure transactions. The first and the most important one is to Verify Recipient Details. Always Double-check the recipient’s bank account information before initiating a transfer.

The second one is to Use Trusted Banks and Services. Experience piece of mind when using reputable financial institutions for wire transfers.

Beware of phishing scams and fraudulent emails requesting wire transfers. Always verify the authenticity of payment requests.

You can regularly check your bank statements to detect any unauthorized transactions and enable Security Features like two-factor authentication (2FA) and transaction alerts.

Wire Transfer Fees

Wire transfers typically involve fees that vary depending on the bank, transfer amount, and destination.

|

Domestic Wire Transfer |

range from $15 to $35 per transaction |

|

International Wire Transfer |

Range from $30 and $50 + possible currency exchange fees |

💡Make sure to consider Intermediary Bank Fees. Some international transfers incur additional fees from intermediary banks.

Also Read: What is Western Union?

Alternatives to Wire Transfers

While wire transfers are efficient, there are alternative payment methods available, including:

Online Payment Services: Platforms like PayPal, Wise, and Revolut offer cost-effective international transfers.

Cryptocurrency Transfers: Digital currencies like Tether enable fast, borderless transactions with lower fees.

You can buy Tether USDT in EZDEX and transfer it anywhere across the world.

EZDEX Simplifies Transfers

Wire transfers are a fast, secure, and reliable way to send money domestically and internationally. While they come with certain fees and security considerations, they remain a preferred choice for large transactions and urgent payments.

EZDEX provides a range of money transfer options to suit different financial needs:

- Flexible transfer methods: Choose from wire transfers, direct debit, or cryptocurrencies payments to suit your preferences.

- Great exchange rates: EZDEX often provides better rates and lower fees than many banks and other money transfer services.

- Transparent fees: No hidden charges with EZDEX clear pricing.

- Global coverage: EZDEX offers services to many countries all around the world.

- Secure and reliable: Strong security measures and easy-to-use web platform ensure a safe and seamless experience.

Read the latest news and announcements in this section.

Read the latest tutorials about payment service providers in this section.

You can access full guides and tutorial to use EZDEX services in this section.

Step by step tutorials and photo guides are available in this section.

Access the latest information about financial and economical matters in Turkey in this section.

Access the latest information about financial and economical matters in UAE in this section.

Explore expert guides, tips, and strategies for understanding and working with gold. Learn everything from basics to advanced knowledge.