What is a SWIFT Code? A Guide to SWIFT or BIC Code

When it comes to international money transfers, one of most popular methods is SWIFT. Many individuals and businesses rely on SWIFT transfer for secure, quick, and efficient international transactions. SWIFT codes, also referred to as Bank Identifier Codes (BIC), play a critical role in facilitating international transactions through the SWIFT network. With SWIFT codes in place, international payments become faster and also more reliable and secure. In this article we will learn about BIC and how it is important.

Table of Contents

What is a SWIFT Code?

A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique identification code used to verify the identity of financial institutions in international transactions. SWIFT or Society for Worldwide Interbank Financial Telecommunication, the organization responsible for overseeing this global messaging system.

SWIFT codes are primarily used for secure and accurate communication between banks. The standardized format of SWIFT codes minimizes confusion between banks across different countries, streamlining payments and reducing the likelihood of errors.

Each SWIFT code is a unique combination of 8 to 11 characters, identifying both the bank and its specific branch. The code ensures funds arrive at the correct destination without confusion or delays.

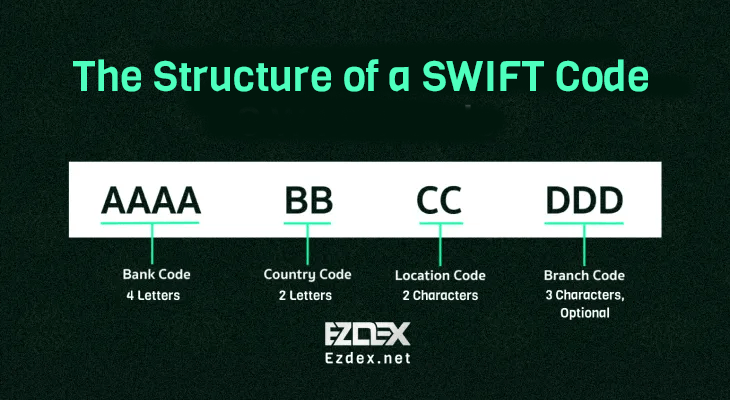

The Structure of a SWIFT Code

A SWIFT code consists of 8 to 11 characters, each with a specific purpose:

- Bank Code (First 4 Letters): These letters represent the bank's name and help identify it in the global financial system.

- Country Code (Next 2 Letters): These two letters specify the country where the bank is located, following the ISO 3166-1 alpha-2 standard.

- Location Code (Next 2 Characters): These characters (letters or numbers) denote the bank’s main office location or city.

- Branch Code (Last 3 Characters, Optional): This optional code specifies a particular branch. If omitted, the code refers to the bank's head office.

For example, the SWIFT code "CHASUS33" belongs to JPMorgan Chase Bank in New York, USA. Here:

"CHAS" is the bank code for JPMorgan Chase.

"US" represents the country, the United States.

"33" identifies New York City as the bank’s main location.

Why is a SWIFT/BIC Code Important?

BIC codes play a crucial role in ensuring accurate and secure international transactions. Without a SWIFT code, banks would struggle to identify the correct recipient bank, leading to delays and potential errors.

If you want to know how long does a SWIFT transfer take you can click on the link and read the article.

Here are a few reasons why SWIFT/BIC codes are essential:

- Global Identification: SWIFT codes provide a unique identifier for banks across the globe, eliminating confusion in international transactions.

- Secure Transactions: SWIFT codes help maintain high-security standards by creating a structured communication system that minimizes risks.

- Efficient Processing: The code streamlines the money transfer process, reducing time and minimizing administrative errors.

How Do SWIFT Codes Work in International Money Transfers?

When you initiate an international money transfer, your bank communicates with the receiving bank using the SWIFT network. Here’s how the process generally works:

- Sender's Bank Sends a Message: Your bank uses the SWIFT network to send a message to the receiving bank, including details such as the sender's information, recipient’s account number, amount, and SWIFT code.

- Verification Process: The receiving bank verifies the information, especially the SWIFT code, to confirm the sender’s bank and location.

- Funds Transfer: Once verified, the transaction is processed, and funds are transferred from the sender’s account to the recipient’s account.

- Confirmation and Notification: The receiving bank notifies the recipient that the funds have arrived, and both banks record the transaction.

How to Find a BIC Code?

As mentioned, finding the correct SWIFT/BIC code is essential to avoid any delays or errors in an international transfer. Here are several methods to find a bank’s SWIFT code:

- Bank Statements

- Bank's Official Website

- Online SWIFT Code Directories

- Banking Apps

SWIFT Codes vs. IBANs: What’s the Difference?

While SWIFT codes identify the bank involved in an international transaction, an IBAN (International Bank Account Number) specifies an individual bank account, mostly within Europe. Here’s a quick comparison:

|

Feature |

SWIFT Code |

IBAN |

|

Purpose |

Identifies the bank |

Identifies an individual account |

|

Scope |

Global |

Primarily Europe |

|

Length |

8-11 Characters |

Up to 34 Characters |

|

Components |

Bank Code, Country Code, Location Code, Branch Code (optional) |

Country Code, Account Number, etc. |

Both codes are often used in tandem for international payments, especially within Europe and when using the SEPA network.

Key Points to Remember about SWIFT Codes

💡Purpose: SWIFT codes are essential for identifying banks in international transactions.

💡Structure: Comprised of 8-11 characters, including bank, country, location, and branch identifiers.

💡Importance: Ensures secure, accurate, and efficient cross-border transactions.

💡Finding a SWIFT Code: Look on bank statements, bank websites, or online directories, or contact customer support.

💡Difference from IBAN: SWIFT codes identify banks, while IBANs identify individual accounts.

Read the latest news and announcements in this section.

Read the latest tutorials about payment service providers in this section.

You can access full guides and tutorial to use EZDEX services in this section.

Step by step tutorials and photo guides are available in this section.

Access the latest information about financial and economical matters in Turkey in this section.

Access the latest information about financial and economical matters in UAE in this section.

Explore expert guides, tips, and strategies for understanding and working with gold. Learn everything from basics to advanced knowledge.