How Long Does a SEPA Transfer Take? A Comprehensive Guide

SEPA (Single Euro Payments Area) transfers are essential for fast, convenient euro transactions across Europe and other participating regions. Whether you're a business owner, freelancer, or individual making cross-border payments, understanding SEPA transfer times can help you manage your finances better. This guide will cover how long SEPA transfers typically take, factors influencing the speed of transfers, and some useful tips to ensure a smooth transfer process.

Table of Contents

Is SEPA Fast?

The SEPA system was established to streamline euro transactions across European countries, eliminating the need for complicated international banking processes. SEPA transfers allow euro payments between bank accounts in participating countries under standardized regulations and fees, aiming to create a "domestic" experience for cross-border transactions.

SEPA transfers are generally fast, but the speed can vary based on the type of SEPA transfer used.

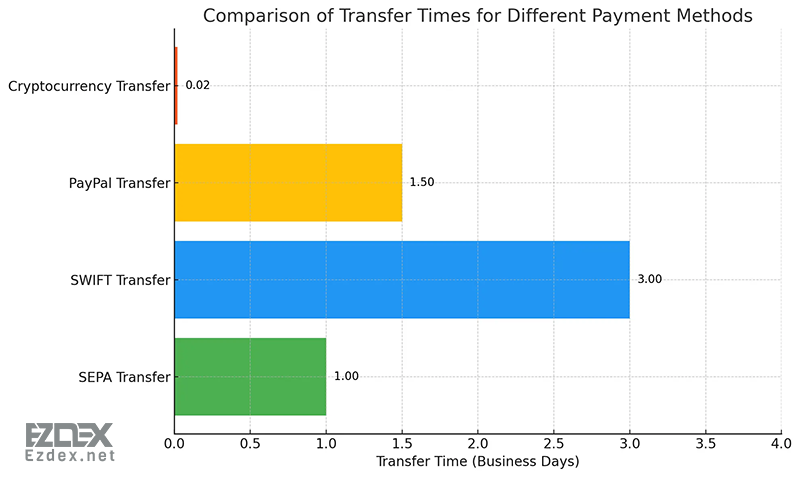

SEPA transfers offer a fast, efficient way to send euros across Europe. The chart below is comparing the average transfer times for different payment methods.

SEPA includes 36 countries: the 27 EU member states, as well as Iceland, Norway, Liechtenstein, Switzerland, and some other territories. For a complete list, check your bank’s official SEPA regions information or consult with your financial institution.

🔗Also Read: What is SWIFT in banking?

How Long Does a SEPA Transfer Take?

The typical time for a SEPA transfer can vary based on factors like the type of transfer and the time of initiation.

Below is an outline of SEPA transfer types and their associated time frames.

|

SEPA Transfer Type |

Expected Transfer Time |

|

SEPA Credit Transfer |

1 business day |

|

SEPA Instant Transfer |

Within 10 seconds (24/7 availability) |

|

SEPA Direct Debit |

1-2 business days after initiation |

|

Cross-Border SEPA Transfer |

1-2 business days, depending on banks |

- SEPA Credit Transfer: This is the standard SEPA transfer, typically taking 1 business day to reach the recipient. It operates during business hours and may be delayed if initiated after cut-off times or during weekends/holidays.

- SEPA Instant Transfer: SEPA Instant transfers are processed almost immediately, typically within 10 seconds or less. They’re available 24/7, even on weekends and holidays, making them ideal for urgent transactions. However, not all banks support SEPA Instant, so check with your bank before expecting instant delivery.

- SEPA Direct Debit: This allows organizations to collect payments from your account after authorization. It generally takes 1-2 business days from the transaction initiation date.

- Cross-Border SEPA Transfer: For cross-border payments outside your country but within the SEPA region, transfers usually take 1-2 business days. Some banks may take longer if they rely on intermediaries.

🔗Looking for a faster and cheaper method for sending funds to Europe? Try EZDEX international transfer services.

Factors That Influence SEPA Transfer Times

Several factors can influence how quickly your SEPA transfer arrives:

- Bank Cut-off Times: Most banks have specific cut-off times for processing SEPA transfers. Transfers initiated after the cut-off may be processed the next business day.

- Weekends and Holidays: Standard SEPA transfers do not process on weekends or public holidays. If you initiate a transfer on a Friday evening, it may not complete until the following Monday.

- Bank Processing Speed: Each bank has its own processing time for SEPA transactions. Larger institutions often have faster processing times, but this isn’t guaranteed.

- Type of SEPA Transfer: As mentioned, SEPA Instant transfers process in real-time, while standard SEPA Credit Transfers usually take one business day.

Tips for Faster SEPA Transfers

Consider the tips below for quicker transfers and payments via the SEPA system.

💡Use SEPA Instant: If available, opt for SEPA Instant for real-time transfers. Not all banks offer this, but it can save significant time if supported.

💡Schedule Ahead of Time: To avoid delays, try initiating SEPA transfers before the bank's cut-off time. This increases the likelihood of same-day processing.

💡Check Public Holidays: Different countries may have bank holidays that could impact transfer times. Avoid scheduling important transfers near holiday weekends.

💡Verify Bank Account Details: Double-check all account details before initiating the transfer. Errors can lead to delays and even reversal of funds.

🔗Also Read: What is BIC?

Read the latest news and announcements in this section.

Read the latest tutorials about payment service providers in this section.

You can access full guides and tutorial to use EZDEX services in this section.

Step by step tutorials and photo guides are available in this section.

Access the latest information about financial and economical matters in Turkey in this section.

Access the latest information about financial and economical matters in UAE in this section.

Explore expert guides, tips, and strategies for understanding and working with gold. Learn everything from basics to advanced knowledge.