Bank Transfer Deposit Guide on EZDEX

Welcome to the EZDEX Bank Deposit Guide. High transaction fees and the limitations associated with payment processing through traditional banking gateways have led both users and exchanges to adopt direct bank transfers as a more efficient method for funding accounts. EZDEX, similar to many other exchanges, provides this functionality. However, there is one key distinction:

Unlike centralized exchanges, at EZDEX you transfer funds directly to the account of the exchanger or final seller, without intermediaries. As a result, you avoid paying substantial fees to third-party service providers.

Important Notes Before Submitting a Bank Deposit Request

🔹 The bank transfer option will only be available after completing the mandatory identity verification (KYC) process.

🔹 Once your transfer is completed and verified, your wallet balance will be updated instantly. You can then convert the deposited funds into your desired currencies, thereby mitigating exposure to market volatility.

To safeguard against potentially fraudulent activities, a temporary transfer restriction—equivalent to the USD value of your deposit—will be applied to your total assets for a period of 24 to 72 hours. After this period, the restriction will be automatically lifted.

Submitting a Bank Deposit Request

To submit a bank deposit request, please follow the steps below:

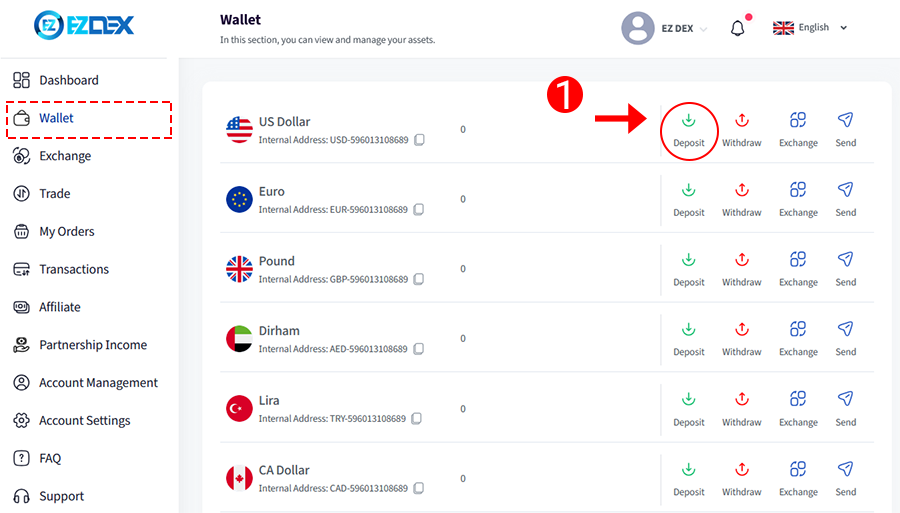

1. In the Wallet section of your account, select the "Deposit" option.

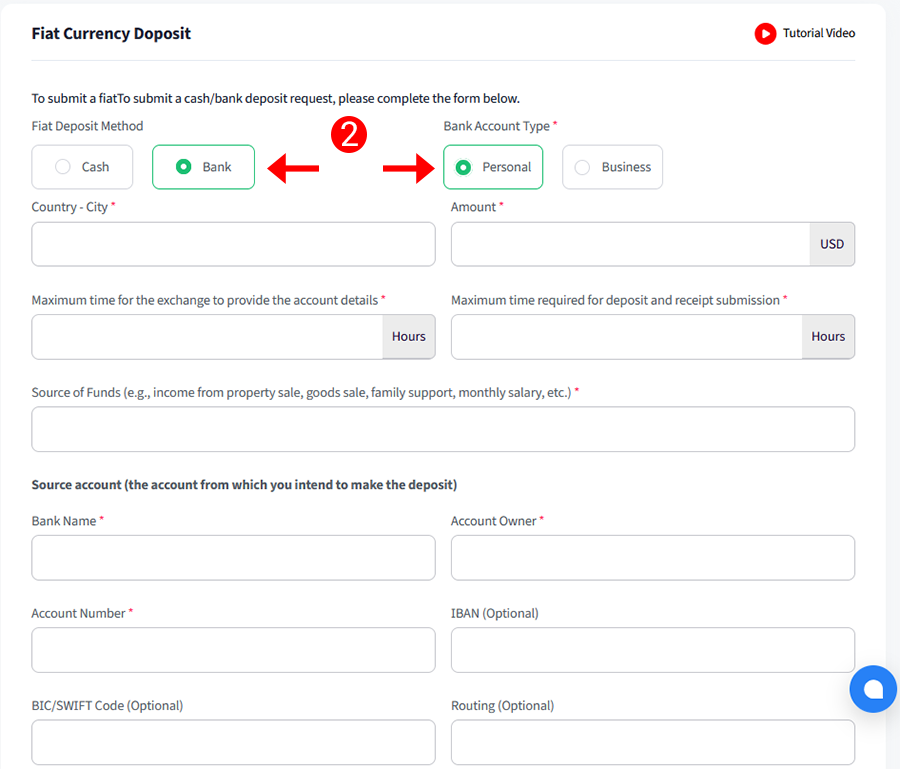

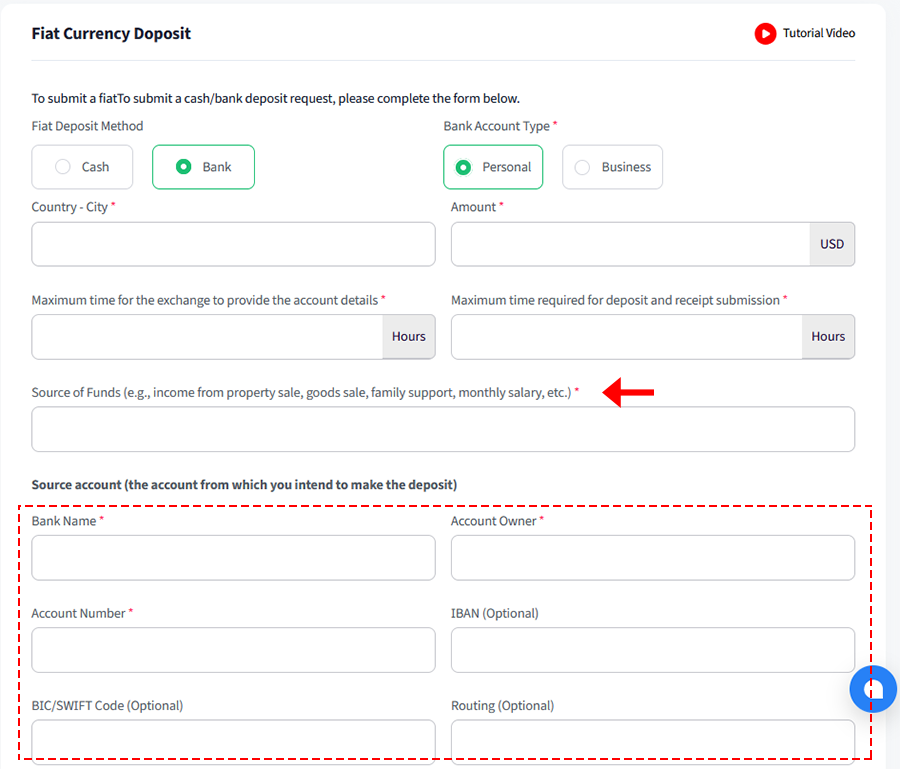

2. In the form provided, choose Bank Transfer as the deposit method and specify your account type according to your banking information. The account type can be either Personal or Corporate.

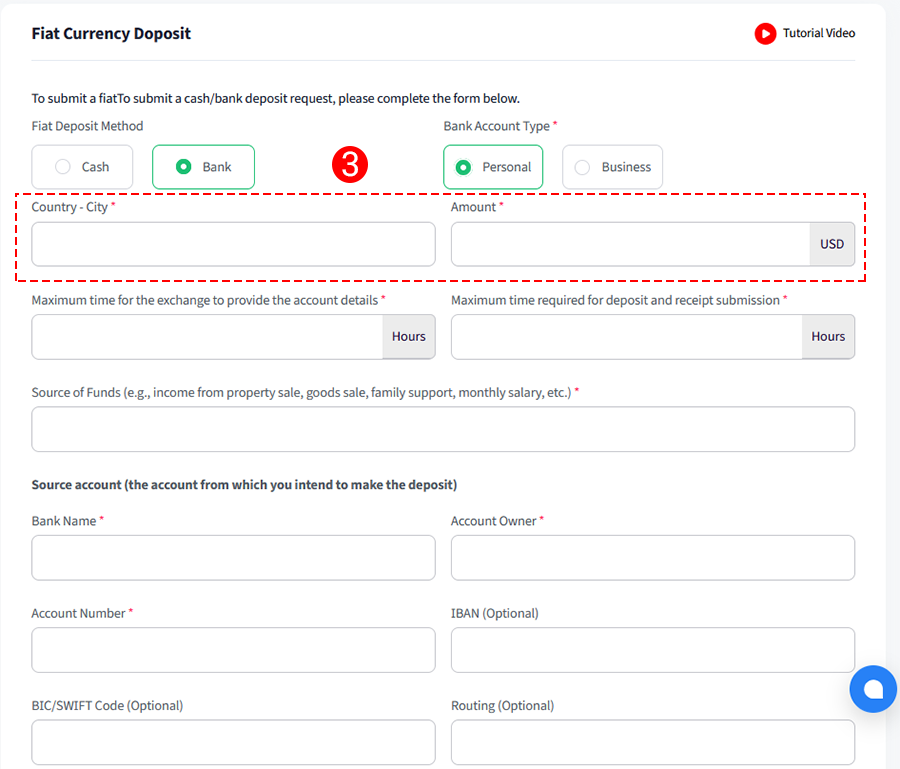

3. Enter the origin country and city, as well as the amount you wish to deposit.

⚠️ Note: While EZDEX supports large deposit and withdrawal transactions through reputable and established exchangers, it is recommended to split large amounts into smaller requests. This reduces the likelihood of transaction limits and increases the chances of successful acceptance.

For example, if you intend to deposit 200,000 AED, it is advisable to submit two separate requests of 100,000 AED each, thereby improving the likelihood of acceptance by a wider range of users and exchangers.

Deposit Guarantee for Bank Transfer Cancellation or Delay

For most bank deposit requests, you are required to deposit the equivalent of 1% of the USD value of the transfer amount into the designated wallet as a “Cancellation or Delay Guarantee.”

📌 This amount will remain frozen in your wallet until the transaction is fully processed, after which it will be released.

The purpose of this guarantee is to accelerate the transaction process, prevent default by either party, and establish mutual accountability for completing the order. In cases of breach or delay, the guarantee amount will be deducted from the responsible party and partially compensated to the counterparty. For further details regarding penalties for delays or non-fulfillment, please refer to the dedicated training guide.

Example:

If the deposit amount is 100,000 AED, its approximate USD equivalent is 27,248. Therefore, the guarantee deposit would be around 272.48 USD.

In this example, since the exchanger has requested the guarantee in Tether (USDT), you must first deposit and lock this amount (272.48 USDT) in your wallet before submitting the request. This ensures the seriousness of your intent to proceed with the transfer. Once the process is completed, you will be able to withdraw the deposited USDT or convert it into other required assets for transfer.

Scheduling Settings in the Deposit Request Form

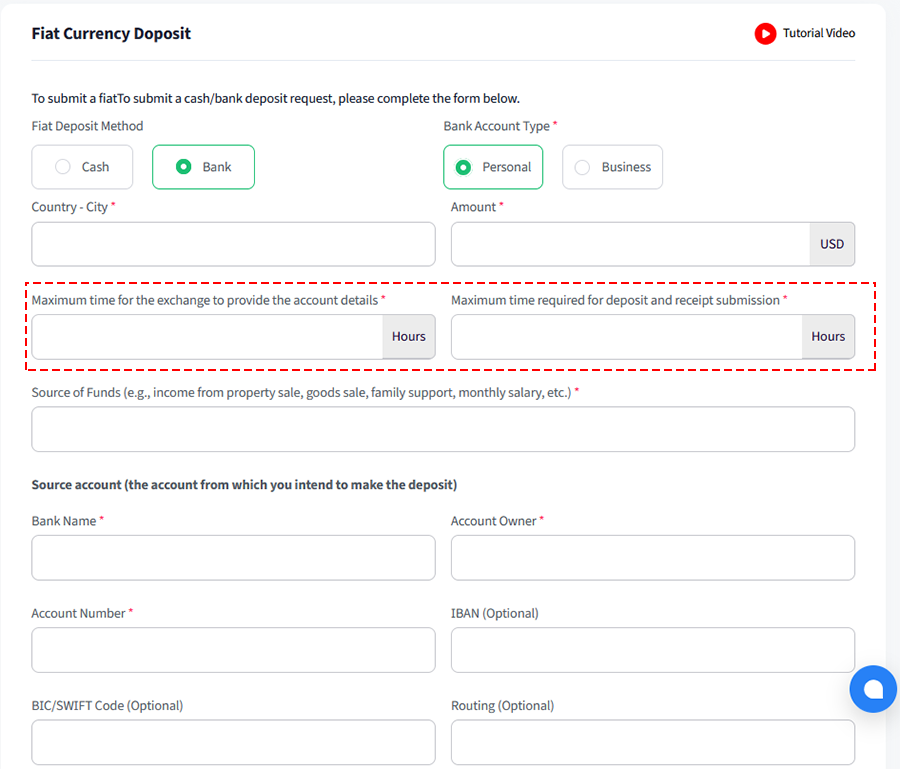

Within the request form, you will need to specify several timeframes:

🕒 Timeframe for the exchanger to provide account details:

This is the period allowed for the exchanger to share their bank account information. The countdown starts from the moment your request is submitted.

Ensure that this timeframe is aligned with the exchanger’s working hours.

🕑 Your timeframe for making the deposit and submitting the receipt:

This is the period you have, after receiving the account details, to transfer the funds and upload the payment slip. The duration should not be too short (to avoid lack of sufficient time) nor too long (to prevent the exchanger from declining your order).

📌 Practical Example:

If you submit your request at 22:00 and set the account-provision timeframe to 14 hours, the exchanger will have until 12:00 noon the next day to provide their banking details.

If you then set the deposit receipt submission deadline to 4 hours, it means you must upload your payment slip by 16:00 the same day.

Entering Additional Information

Next, you will need to provide the following details:

- Source of funds: For example, “Income from property rental.”

- Origin account details: The bank account from which the funds will be transferred.

Once completed, click on the Submit Request button.

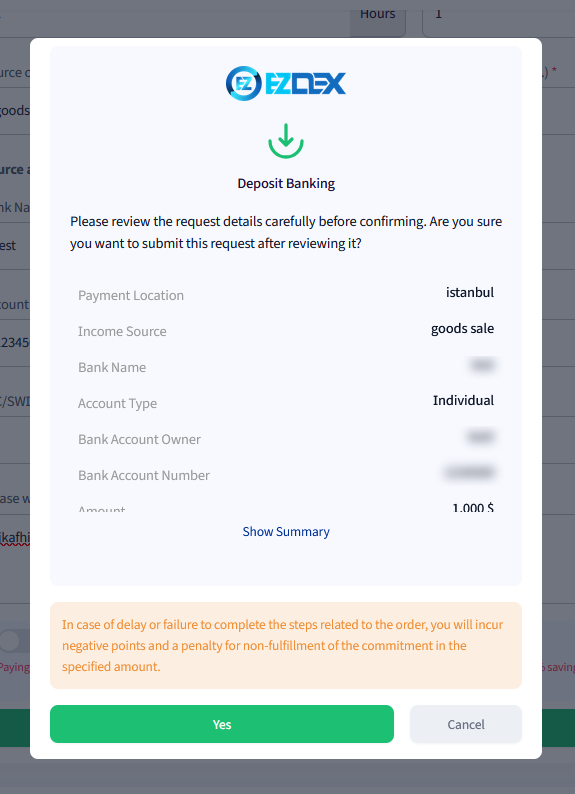

Order Preview

After submitting the form, a preview of your order details will be displayed, including:

- Requested amount

- Cancellation or delay guarantee (if applicable)

- Timeframes for deposit and receipt submission

- Net amount to be received upon completion of the order

If all the details are correct, click on Final Confirmation. At this stage, your order will be sent to the exchangers’ dashboard. This marks the first step of the order process, after which you must wait for one of the exchangers to accept your request.

Order Acceptance

This step represents the second stage of the order processing workflow and is carried out by the exchanger.

✅ During business hours, order acceptance typically takes between 15 and 120 minutes.

⏱ Outside of business hours (nights or holidays), depending on circumstances, it may take up to 24 hours.

Once the order is accepted and account details are provided by the exchanger, you will be notified via email and in-app notification. You can also refresh the page to view the provided bank account information.

Fund Transfer Stage

In the third stage, you must transfer the exact amount specified to the bank account provided by the exchanger.

Pay close attention during the transfer process, as any errors (such as sending an incorrect amount or transferring to the wrong account) will be your responsibility.

After completing the transfer, upload the bank receipt and tracking number in the designated form and confirm the deposit.

Deposit Confirmation by Exchanger

In the fourth stage, the exchanger is required to verify receipt of the funds after checking their account.

Depending on the currency type and transfer network, this verification may take anywhere between 1 to 72 hours.

Final Review by EZDEX

If stages three and four are completed without issue, in the fifth stage, the EZDEX compliance team will confirm the transaction within a few minutes, and the net amount will be credited to your wallet.

If a dispute arises between the parties (e.g., failure by one side to confirm the deposit), the order will be escalated to the EZDEX compliance unit, which will review the supporting documents and issue a final decision.

Order Security and Support

In case of any dispute, you need not worry:

All fund recipients on EZDEX are required to maintain a guarantee deposit equal to the amount they receive.

The EZDEX support team will carefully review documentation from both parties and is ready to resolve any potential disputes.

Additional Notes on Bank Deposit Stages and Statuses

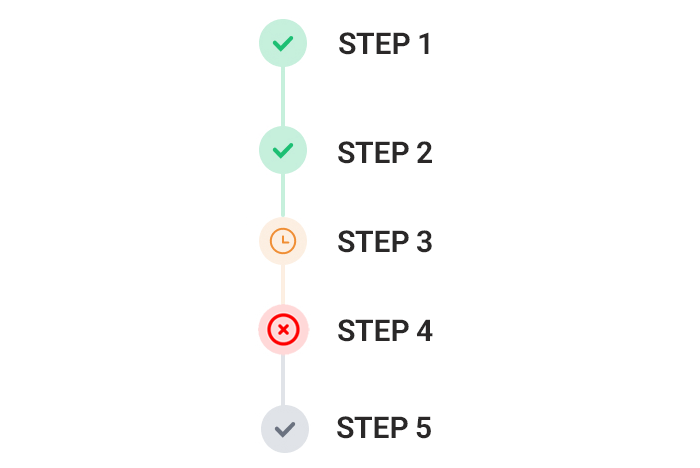

Every bank deposit order in EZDEX consists of five consecutive stages, which are usually completed within minutes during business hours. These stages are designed to ensure precise management, high transparency, and to minimize the likelihood of disputes.

The steps are sequentially carried out by the user, the exchanger, and the EZDEX compliance unit. Each stage of this process is represented by a specific status, which can be tracked via color-coded icons.

🔄 The Five Stages of Bank Deposit Order Processing

Step 1 – Request Submission by the User

The user enters the required details such as deposit amount, origin country, bank account, timeframes, and source of funds, then submits the order.

Step 2 – Account Details Provided by the Exchanger

The exchanger who accepts the order must provide the destination bank account details within the timeframe set by the user. If the account information is not submitted within the specified time, the order will be canceled or marked as inactive.

Step 3 – Fund Transfer and Receipt Submission by the User

After receiving the account details, the user must transfer the exact specified amount without error and upload the bank receipt along with the tracking number in the panel.

Step 4 – Deposit Confirmation by the Exchanger

The exchanger, after reviewing their bank account, confirms that the funds have been deposited and that the details match the order.

Step 5 – Final Review by the EZDEX Compliance Unit

If all previous steps have been completed correctly and without dispute, the compliance unit finalizes the order within a few minutes, and the net deposit amount is credited to the user’s wallet.

If at any stage a discrepancy or delay occurs (e.g., missing receipt submission, mismatched amount, or lack of confirmation by the exchanger), the order is automatically referred to the compliance unit. At this stage, EZDEX specialists will review the documentation provided by both parties and contact them if necessary, in order to make the final decision (confirmation or rejection of the order and assignment of responsibility).

Order Statuses and Color Indicators

Each of the five stages described above may fall under one of the following statuses during the processing of an order. These statuses are displayed with color-coded icons for easier tracking:

🟢 Completed: The step has been successfully finalized, and the process should proceed to the next pending (orange) step.

🔴 Canceled or Not Confirmed: The step was canceled by one of the parties, or the relevant party has not confirmed its completion.

🟠 Pending: No action has yet been taken for this stage, and it is awaiting the responsible party’s action.

⚫ Inactive: The step is currently inactive due to either the stage not yet being reached or the request having expired.

These statuses, along with the display of the responsible party for each step, allow you to track the real-time progress of your order and take timely action where required. Exchangers can also monitor these statuses to follow up on the stages and respond to your orders accordingly.

Read the latest news and announcements in this section.

Read the latest tutorials about payment service providers in this section.

You can access full guides and tutorial to use EZDEX services in this section.

Step by step tutorials and photo guides are available in this section.

Access the latest information about financial and economical matters in Turkey in this section.

Access the latest information about financial and economical matters in UAE in this section.

Explore expert guides, tips, and strategies for understanding and working with gold. Learn everything from basics to advanced knowledge.