10 Cheapest Countries to Buy Gold in 2026: Bullion & Jewelry

This guide reveals the cheapest countries to buy gold in 2026, based on real-time data. You will find why these spots offer the lowest rates, where to shop safely, and practical tips for tourists and investors.

Table of Contents

The Short Answer: Which country is the cheapest?

As of 2026, China (Hong Kong) and the UAE (Dubai) remain the cheapest places to buy physical gold due to zero sales tax and highly competitive market premiums. For pure investment bullion, Switzerland and Singapore are the top choices for security and tax exemptions.

Why Gold Prices Vary So Much by Country

Gold is traded globally, but local gold prices differ due to:

- Taxes & VAT: Zero or refundable VAT in hubs like Hong Kong and Dubai vs. 3-18% GST/customs in places like India.

- Import Duties & Supply: Gold producing or refining powerhouses like Switzerland and UAE have lower premiums.

- Currency Strength & Market Competition: Weak local currencies or intense competition like Turkey and Thailand drive prices down.

- Making Charges: Minimal for bullion or bars and higher for intricate jewelry.

- Economic Factors: Safe-haven demand, tourism, and refinery access keep premiums low.

Where is the Cheapest Place to Buy Gold in 2026?

Check the table below for the quick ranking:

| Rank | Country |

| #1 | UAE (Dubai) |

| #2 | Hong Kong |

| #3 | Switzerland |

| #4 | Singapore |

| #5 | Turkey |

| #6 | Indonesia |

| #7 | Thailand |

| #8 | Qatar |

| #9 | Malaysia |

| #10 | Saudi Arabia |

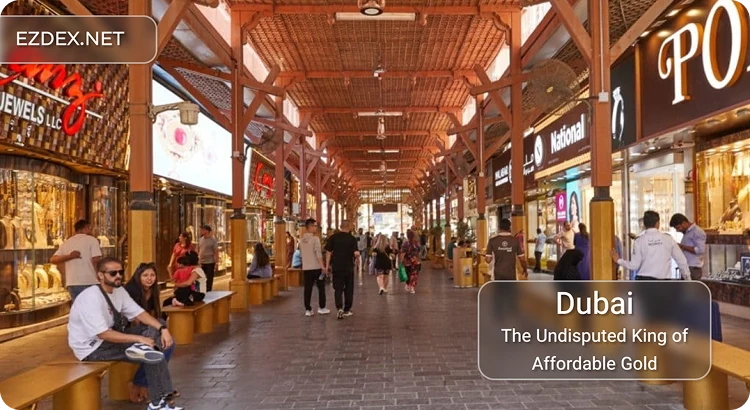

UAE (Dubai)

Dubai earns its “City of Gold” nickname with the iconic Gold Souk that has over 300 shops offering everything from 24K bars to ornate jewelry. Zero import duties on gold, competitive making charges which is as low as 5-10% for jewelry, and a 5% VAT that tourists can fully refund make it a top pick.

Dubai is the best place for jewelry lovers and bulk bullion buyers.

Purity: Commonly 22K and 24K

💡Learn more on purity assesment on: Gold Karat Full Guide

Tip: Shop in Deira Gold Souk or Dubai Mall’s luxury jewelers. Negotiate 5-15% off listed prices. Check the Hallmarks from Dubai Central Labs to ensure purity.

Hong Kong

There are No sales tax or VAT on gold in Hong Kong. This makes it consistently one of the absolute cheapest spots to buy gold. Major chains like Chow Tai Fook and Luk Fook dominate Nathan Road and Tsim Sha Tsui. Excellent for both investment bars and Cantonese-style jewelry.

Hong Kong is best for pure investment with high-purity (99.99%) products.

Switzerland

Legendary refiners like PAMP, Valcambi and Argor-Heraeus are in Switzerland. The country offers LBMA-certified bars at near-spot prices. Investment gold is VAT-exempt. Zurich and Geneva banks and dealers provide discreet, ultra-secure purchases.

It is Best for investors wanting 999.9 fineness and vault storage options.

Singapore

Investment-grade gold, including bars and coins that are ≥99.5% pure, is fully GST-exempt since 2012 in Singapore. Secure bank vaults and reputable dealers in the Central Business District make it ideal for long-term storage or immediate purchase.

Singapore is best for wealth preservation and offshore gold holdings.

Turkey

Istanbul’s Grand Bazaar and covered markets offer stunning Ottoman-style jewelry at low labor costs. Competitive premiums and a vibrant local market keep prices attractive even after currency conversion.

Turkey is best for those who are looking for unique and handcrafted pieces.

Also Read: Is Gold Cheaper in Dubai Compared to Turkey?

Let us have a quick highlight on 6-10:

Indonesia & Thailand: Strong local mining in addition to tourist-friendly souks in Bali and Bangkok.

Qatar, Malaysia & Saudi Arabia: GCC tax advantages and growing gold markets mirror Dubai’s model.

Countries Where Gold is Usually Expensive

Gold tends to be more expensive in:

- United States (state sales taxes apply in many areas)

- United Kingdom (VAT on certain gold types)

- Canada (sales taxes may apply)

Gold Jewelry vs. Bullion: What Should You Buy Abroad?

Bullion, Bars and Coins have the Lowest premium (1-3% over spot). These are ideal for investment. Buy in Switzerland, Singapore, or Hong Kong.

Jewelry has higher making charges (8-25%) but beautiful designs and cultural value. Dubai and Turkey excel here.

Keep in mind that resale value is highest for bullion, while jewelry often sells back at melt value only.

Important Things to Consider

Here are some tips to consider before making purchase in these countries.

1. Customs Regulations

Many countries require declaration if you carry gold above a certain value. For example, for USA and EU, you must report purchases over $10,000 USD.

Always declare accurately and check latest rules on your government customs site before travel.

2. Currency Exchange Rates

Exchange rates can impact overall savings.

3. Authenticity & Certification

Always buy:

- Hallmarked gold

- Certified bullion

- From reputable dealers

Avoid street vendors and “too good to be true” deals.

Also make sure to get a detailed receipt showing weight, purity, price per gram, and shop details.

4. Resale Value

Gold bought in Switzerland or Dubai may have better international resale liquidity.

Read the latest news and announcements in this section.

Read the latest tutorials about payment service providers in this section.

You can access full guides and tutorial to use EZDEX services in this section.

Step by step tutorials and photo guides are available in this section.

Access the latest information about financial and economical matters in Turkey in this section.

Access the latest information about financial and economical matters in UAE in this section.

Explore expert guides, tips, and strategies for understanding and working with gold. Learn everything from basics to advanced knowledge.