What are Neo Banks? Ultimate Guide to Function & Security

No one can ignore or deny the advancement of technology in financial industry. At the forefront of transformation in financials are neo banks. Neo banks are digital financial institutions redefining the way people manage money. In this guide, we are going to learn what neo banks are, their advantages, key features, and how they are different from traditional banks. So, if you are interested in using neo bank, read the rest of this article.

Table of Contents

What Are Neo Banks?

Neo banks are financial technology companies that offer banking services primarily through mobile apps and online platforms.

With neo banks all banking actives and transactions are done online. Unlike traditional banks, neo banks have no physical branches. While they focus on leveraging technology to offer seamless, cost-effective, and user-friendly experiences for users.

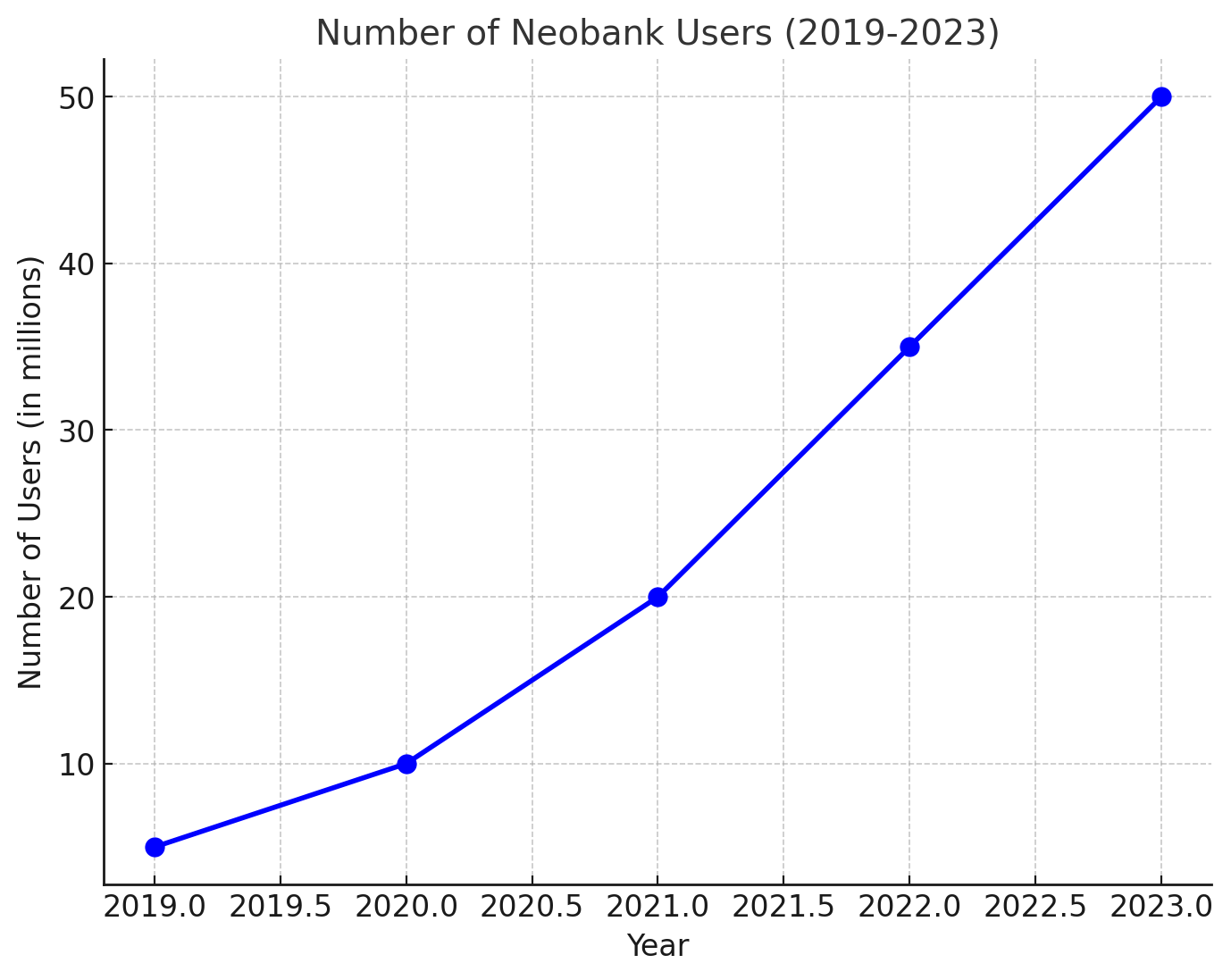

The chart below demonstrates growth in number of neo banks users over time.

💡Some popular neo banks include Chime, Revolut, Monzo, and N26.

💡Some popular neo banks include Chime, Revolut, Monzo, and N26.

Key Features of Neo Banks

Why use neo banks? What do neo banks offer and how do they work that make them an ideal choice for banking? Let us review some of the key features and main advantages.

- Digital Experience: As mentioned earlier, neo banks are built for the digital age, providing services through mobile apps and websites. From opening an account to managing transactions, everything happens online. Imagine that you want to have an international account in Dubai banks. If you choose a neo bank, you do not need to travel to UAE while you can do it all online!

- Low or No Fees: Traditional banking fees are frustrating. Most neo banks eliminate these fees such as account maintenance charges, overdraft fees, and foreign transaction fees.

- Real-Time Notifications: Since these banks are online and work with mobile apps, customers receive instant alerts for transactions. It is easy to track spending and detect fraudulent activity when using neo banks.

- Personalized Financial Tools: Many neo banks offer budgeting tools and other features like spending analytics and savings managements. These tools are designed to help users achieve financial goals.

- Global Accessibility: Neo banks often support multi-currency accounts. No matter where you are across the world, you can use these financial institutions that provide competitive exchange rates. This is the main feature that interests travelers and remote workers.

Generally, the ability to bank from anywhere, at any time, is a major draw for neo bank users. You can save time and effort since you do not need to visit a branch in different cases.

Challenges Facing Neo Banks

Unlike traditional banks, neo banks may lack comprehensive offerings such as mortgages, wealth management, or extensive lending services. In the other hand, Outages, technical glitches, and cyber threats pose risks for digital-only platforms.

That is why in most cases, convincing consumers to trust a digital-only platform with their finances can be challenging, especially for older generations.

Neo Banks vs. Traditional Banks

In the table below we quickly review some of the most significant differences between traditional and neo banks. Use this table for an overview of the differences between neo banks and traditional banks.

|

Feature |

Neo Banks |

Traditional Banks |

|

Physical Branches |

None |

Widely Available |

|

Fees |

Low to None |

Higher Fees |

|

Speed |

Instant Account Setup |

Lengthy Processes |

|

Personalization |

Advanced Financial Tools |

Limited Tools |

|

Loan Options |

Limited |

Comprehensive |

Neobanks set themselves apart from traditional banks by offering low-cost or fee-free services and providing tools designed to support financial well-being.

How to Choose the Right Neo Bank

When selecting a neo bank, consider the following factors:

- Security Measures

- Fee Structure

- Features

- Customer Support

- User Reviews

Are Neo Banks Secure?

You may wonder if your money is safe at a neobank, especially when it comes to deposit protection. What you need to know is that most neobanks work with traditional banks. This means that they follow necessary regulations, and are FDIC insured.

When choosing to create an account in a neo bank, make sure it is FDIC insured or works with a partner bank that is FDIC insured. Only in this case the funds in the account will be eligible for FDIC insurance.

⚠️Some neobanks allow you to buy Tether and other investments, like stocks and cryptocurrency, but keep in mind that these investments aren't insured in the same way as deposits if the bank is not FDIC insured.

The Future of Neo Banks

As technology continues to evolve, neo banks will expand their offerings and improve user experiences. With advancements in artificial intelligence, blockchain, and open banking, the potential for innovation is so high.

That is why many financial experts predict that neo banks will play a significant role in financial future, particularly in underserved regions. While neo banks are not without challenges, their rise signals a broader shift toward digital-first banking solutions.

Ready to explore the world of neo banks? Comment your ideas below!

Read the latest news and announcements in this section.

Read the latest tutorials about payment service providers in this section.

You can access full guides and tutorial to use EZDEX services in this section.

Step by step tutorials and photo guides are available in this section.

Access the latest information about financial and economical matters in Turkey in this section.

Access the latest information about financial and economical matters in UAE in this section.

Explore expert guides, tips, and strategies for understanding and working with gold. Learn everything from basics to advanced knowledge.